Paying Less for College

Are you curious about paying less for college? You may be surprised to learn that you can significantly lower out-of-pocket costs, maximize grants and scholarships, and use your resources in a more tax-advantaged, cost-efficient way. Even if you don’t think you’ll qualify for financial aid, understanding how best to pay for college can make a tremendous difference.

First of all… do I even qualify for financial aid or scholarships?

Actually, yes. Even if you think that your family won’t qualify on paper, it’s worth filling out the FAFSA or CSS profile just in case. In fact, this is how some schools allocate merit aid to their freshman class. So, filling everything out is important! Further, scholarships exist for a lot of different demographics.

Finally, there are other types of aid and financial strategies that you may never even have heard of yet. You may be surprised to learn that you can significantly lower out-of-pocket costs, maximize grants and scholarships, and use your resources in a more tax-advantaged, cost-efficient way. Even if you don’t think you’ll qualify for financial aid, understanding how best to pay for college can make a tremendous difference.

That’s why we partner with the experts at SmartTrack. They put in the extra work to make sure you don’t pay any more than you have to for your college tuition. In fact, you may end up paying less for college than you ever thought possible.

When should I start thinking about this?

Almost everyone interested in pursuing higher education should start planning as early as possible! The financial decisions you make now will impact how much you pay later.

- Parents of 9th and 10th graders are encouraged to start planning early.

- And of course, 11th & 12th grade families don’t have a minute to lose!

Note from the Empowerly team:

If you’re interested in more information about the webinar, send our webinar host an email at <sarah@empowerly.com>. On the other hand, if you’re interested in signing up for future events Empowerly will hold, sign up for email updates from the blog. Doing so will keep your finger on the pulse of what’s new. We’re here to help you launch your best future now!

Background on your presenter

Cyndi is a popular speaker and conducts workshops across the country, educating and empowering parents on the critically important financial piece of college planning. Prior to joining SMARTTRACK ®, she had a successful career in the video business and received a degree in Communication Studies from Northwestern University. Cyndi is also the proud mom of twins who recently graduated from college debt free!

National Program Director @SMARTTRACK College Funding

About Cyndi’s current work:

SMARTTRACK ® College Funding is a national leader in helping families better pay for college. Here’s a little more information about their program and approach…

Our mission is to help families send children to their dream schools without overpaying or going deeply into debt. Until now, access to this information was exclusive to those who could spend thousands of dollars hiring an expensive specialist.

We are very proud to have developed an online resource to make assistance readily accessible for free, and make personalized services affordable to those who need them. We offer professionalism, experience, integrity and results, all within reach.

Next, let’s get into the insights we learned at the webinar.

Am I the only one worried about finances?

Definitely not. Here are the top three concerns that families have about paying for college:

- Paying for and affording college costs

- Possibilities to pay less for college

- Making sure retirement goals stay in tact throughout this process

Do these concerns resonate with you? You are not alone in thinking about all of these things. Let’s dig in.

What is COA?

COA, or Cost of Attendance, is the “all-in cost” per year. This includes fees like:

- tuition

- fees

- housing

- meal plan

- books

- expenses

- some transportation

And all in all, your COA can add up to much more than the straight sticker price on your college’s website! Be sure to plan for a little bit of cushion in your budget for all kinds of additional or hidden expenses that may pop up.

What is EFC?

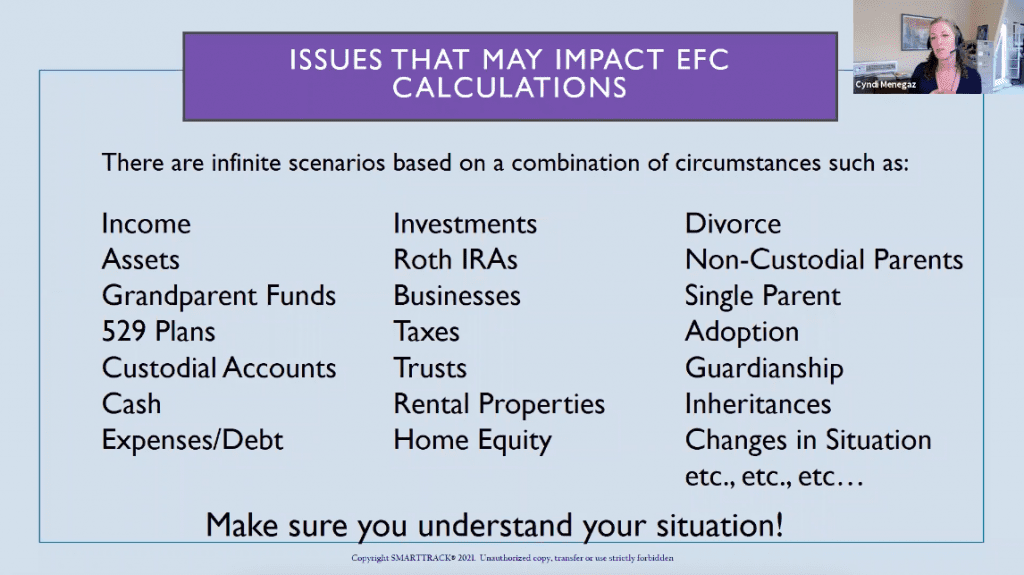

EFC, or Expected Financial Contribution, is the minimum amount per year that schools expect you to pay per year, per student. This is calculated based on a number of different factors when determining what you can pay. Unfortunately, this means that it can also be confusingly inflated!

What are some of the factors that can impact your EFC and negatively impact your total payments for college? Take a look below!

Finally, what can you do to start now?

Here is a message directly from your presenter Cyndi and Empowerly about how to get started on your pathway to paying less for college:

Empowerly is providing all its families with a no-cost, no-obligation professional College Funding Evaluation from SMARTTRACK ® because they know how important the financial piece of college planning is, and that it starts much earlier than you might think. (Families with current seniors, it’s not too late to get some guidance!) We highly recommend you take advantage of this opportunity to discuss your current funding plans.

- Find out if you’re likely to overpay for college

- Ask your financial questions

- Get a second opinion (or a first!) from the nation’s leading college funding experts

- Learn whether there are steps you can take to improve your outcomes

Spend 5-10 minutes now to create your account, complete the quick intake and schedule your free SMARTTRACK ® evaluation.

You MUST use this custom link to qualify!

In conclusion

Finally, if you need more advice on how to organize your finances and start paying less for college, reach out. The Empowerly team is here to help you in this process. We can provide support, writing help, and resources to get you started. Starting off on the right foot is key. From college lists to financial aid, the Empowerly community has you covered. Book a consult today.